Insights

Sprott Insights offers unique analyses and perspectives from the firm’s leading experts on key topics in precious metals and critical materials.

Sprott Gold Report

Dips: The Rx for Acrophobia

With gold and silver reaching new all-time highs, we believe there is still opportunity in both the physical and miners markets. We see structural drivers (central bank demand, inflation resilience and declining trust in fiat currencies) that continue to support long-term allocations to gold and silver.

Sprott Precious Metals Report

Gold Leads as Faith in Fiat Falters

Gold surged to record highs as fading confidence in fiscal and monetary policy drove investors toward hard assets. With long-term yields rising and central banks turning increasingly accommodative, markets are signaling a loss of faith in fiat currencies, fueling gold’s breakout and silver’s potential squeeze.

Sprott Uranium Report

Investors Act with Conviction

Uranium prices and miners surged in September, fueled by tight supply and strong utility demand. The rally drew renewed investor interest, with capital flows into uranium equities and ETFs reinforcing confidence in the sector’s momentum.

Sprott Radio Podcast

The Metals that Make the World

Sprott economic geologist and Senior Portfolio Manager Justin Tolman joins Ed Coyne for a deep dive on demand trends for steel, copper and silver and what it might take to successfully invest in the metals that build the world.

Interview

Where Is Spot Uranium Going?

John Ciampaglia, CEO of Sprott Asset Management, joins Jimmy Connor of Bloor Street Capital at the World Nuclear Symposium 2025. Ciampaglia highlights strong global investor interest in uranium, with both specialist and generalist funds viewing nuclear as a long-term growth story. He notes stabilizing uranium prices, lingering supply challenges and growing demand from utilities, AI and data centers.

Interview

Uranium: At the Fulcrum of AI, National Security and Global Energy Demand

John Ciampaglia, CEO of Sprott Asset Management, highlights takeaways from the September 2025 World Nuclear Symposium: surging uranium demand from electricity, AI and energy security, tech ties like Microsoft and constrained supply supporting higher prices and new mining.

Special Report

Steel Meets Rising Global Electricity Demand

Steel is emerging as a strategic material in meeting global electricity demands, underpinning everything from power generation and transmission to electric vehicles and grid modernization. Demand for green steel is accelerating with market forecasts projecting rapid growth relative to traditional steel.

Video

Active Edge: Why Experience Matters in Metals and Mining Investing

Sprott's Steve Schoffstall and Justin Tolman discuss the newly launched Sprott Active Metals & Miners ETF (METL), which provides active exposure to a broad range of metals. Tolman highlights the team’s rigorous investment process combining top-down sector analysis and bottom-up stock selection, and the importance of site visits in evaluating projects.

Sprott Copper Report

Copper Fundamentals Prevail After Tariff Turmoil

Copper rallied in August, with junior copper miners taking top performance honors. Policy momentum is accelerating as copper gains critical minerals status and attracts major investment. Copper miners are enjoying strong margins as copper demand rises to support electrification, AI and defense.

Sprott Precious Metals Report

Challenges to Fed Autonomy Strengthen Case for Gold

Gold has topped another all-time high above $3,600 per ounce, while silver has reached $41, its highest level since 2011. Both metals may be among the strongest-performing asset classes for the year. We explore how erosion of Fed independence heightens policy risk, reinforcing the strategic role of gold and silver.

Sprott Critical Materials Report

Critical Materials Breakout into a New Bullish Phase

The convergence of national security imperatives, energy transition policies and evolving trade dynamics is fundamentally redefining the role of critical minerals. The breakout in the Nasdaq Sprott Critical Materials Index™ is an early signal of this shift, reflecting technical strength and deep structural drivers.

Video

Copper Clash: Tariffs, Trade Shifts and Opportunity

U.S. copper tariffs are reshaping global markets. In this episode of Metals in Motion, Steven Schoffstall, Director, ETF Product Management at Sprott Asset Management, discusses how copper prices are realigning as fundamentals point to long-term shortages and surging demand from the energy transition.

Video

The Key Drivers of Demand and Volatility in the Precious Metals Space

Nasdaq Trade Talks features Sprott’s Steven Schoffstall and the World Gold Council’s Joe Cavatoni on the key forces driving gold, silver and critical materials, from central bank demand to industrial growth and their role in portfolio diversification.

Sprott Gold Report

A Cure for Financial Dementia

In our view, market euphoria and collective amnesia have left gold miners overlooked despite record profits, soaring margins and aggressive shareholder returns. Gold mining equities are still stuck at bargain basement valuations, and we unabashedly continue to pound the table for precious metals equities and bullion alike.

Sprott Precious Metals Report

Gold Miners Shine in 2025

Gold and silver are up over 25% in 2025, with mining stocks surging more than 50%, yet still undervalued. We see continued upside amid inflation, geopolitical risks and strong fundamentals.

Sprott Copper Report

The Emerging Copper Premium: Policy Risk Meets Physical Scarcity

Copper is being redefined as a national security asset, not just an industrial metal. U.S. tariffs and geopolitical shifts have fractured global pricing and exposed deep supply vulnerabilities.

Silver Report

Silver Investment Outlook Mid-Year 2025

Silver gained nearly 25% through mid-year, and continues to rise in July, as supply remains tight and demand accelerates. With silver crucial to new technologies, the metal is benefiting from powerful structural tailwinds and renewed interest from investors.

Sprott Uranium Report

Uranium’s Mid-Year Momentum

Uranium spot prices jumped nearly 10% in June and uranium miners surged, supported by renewed inflows and global pro-nuclear policy momentum. With AI data centers adding a long-term demand driver, we believe uranium’s structural bull case remains intact.

Video

Copper’s Potential Power Surge: Energy, AI and Beyond

In this episode of Metals in Motion, Steven Schoffstall, Director, ETF Product Management at Sprott Asset Management, discusses copper’s importance to energy and technology, and the associated structural supply deficit resulting from growing demand.

Sprott Precious Metals Report

Gold and Silver Bull Run Continues

Gold and silver have been strong performers in 2025, with both metals up over 25% YTD as global instability drives demand for safe haven assets. Central banks are shifting away from the U.S. dollar, while silver’s breakout suggests a potential supply squeeze ahead.

Interview

Uranium Outlook Mid-Year 2025

John Ciampaglia, CEO of Sprott Asset Management, joins James Connor at the Bloor Street Capital Virtual Uranium Conference to examine the current state of the uranium market. Ciampaglia highlights the market's V-shaped recovery since April and the improved investor sentiment following the absence of tariffs on uranium.

Sprott Copper Report

Copper’s Bullish Setup Strengthens

Copper is surging toward $10,000 per ton as plunging inventories and unexpected supply disruptions expose the market’s tightness. Easing tariff tensions and rising electrification demand are driving bullish sentiment. We believe copper may be heading toward a structural repricing.

Video

COPP Invests in Both Miners and Physical Copper

Beginning June 23, 2025, Sprott Copper Miners ETF (COPP) will provide investors with exposure to physical copper, in addition to pure-play copper miners.

Special Report

Building an Electrified World: The Strategic Role of Critical Materials

As the world races to electrify, demand for critical materials like uranium, copper, silver, lithium and nickel is climbing. These metals are foundational to nuclear power, consumer electronics and high-performance batteries — making them indispensable to meeting rising global energy demand.

Sprott Uranium Report

Uranium’s Bull Market Reawakens

Uranium is back in focus as U.S. nuclear policy accelerates and AI-driven energy demand sparks renewed investor interest. With uranium prices and miners showing strength in May, our outlook remains bullish as fundamentals tighten and sentiment shifts.

Sprott Precious Metals Report

Gold Gains Ground as Faith in the Dollar Erodes

Gold continues its rally as fading confidence in U.S. fiscal policy and the U.S. dollar drives demand for real assets. As we publish, silver is breaking out above $35, supported by structural supply deficits, renewed investor interest and mounting macroeconomic pressures.

Shifting Energy

The White House’s Nuclear Push: What It Means for Uranium Opportunities

In this episode of Shifting Energy (Season 2), John Ciampaglia discusses the major policy shift under President Trump’s new executive orders, which aim to fast-track advanced nuclear technologies and revitalize the entire U.S. nuclear fuel cycle.

Video

Trump’s Executive Orders Set Stage for U.S. Nuclear Expansion

Uranium is back in the spotlight. Steve Schoffstall discusses President Trump's sweeping executive orders to jumpstart America’s nuclear energy industry by streamlining reactor approvals, boosting domestic uranium production and declaring a national emergency over reliance on Russian and Chinese nuclear fuel. With global support for nuclear power building, investors are watching this space closely.

Webcast Replay

Could Silver and Its Miners Shine in Today’s Markets?

In our webcast with Nasdaq, Steve Schoffstall, Director of ETF Product Management, joins Nasdaq’s Jillian DelSignore to discuss silver and silver equity markets, silver’s historic performance during periods of market turmoil, and why the metal and its miners may be a valuable addition to portfolios.

Sprott Uranium Report

Uranium Regains Momentum

Uranium is regaining strength, with spot prices rebounding and momentum returning thanks to renewed utility contracting, tariff clarity and strong long-term fundamentals. The resurgence of the carry trade, rising AI-driven energy demand and China’s ongoing nuclear buildout are reinforcing uranium’s role as a strategic, supply-constrained asset.

Sprott Precious Metals Commentary

A Shaky U.S. Dollar Boosts Gold’s Role as an Alternative Reserve Asset

Gold is gaining prominence as a reserve asset due to a weak U.S. dollar and declining U.S. financials, reaching record highs while equities and bonds fell. We believe this positions gold as a potential anchor for a multi-asset reserve system. Given silver’s correlation to gold, we believe its monetary value will reassert itself in time.

Interview

Sprott CIO on Gold/Silver Miner Selection and Silver Outlook

James Connor of Bloor Street Capital speaks with Maria Smirnova, Sprott CIO, about the firm’s approach to gold and silver miner selection. Smirnova remains bullish on silver, citing a deep supply deficit and its essential role in electrification, despite prices lagging gold due to weak central bank demand and stagnant supply.

Video

Nasdaq’s Just for Funds: Introducing the Sprott Active Gold & Silver Miners ETF (GBUG)

Steve Schoffstall recently joined Nasdaq’s Just for Funds to discuss the launch of the Sprott Active Gold & Silver Miners ETF (GBUG), the only actively managed ETF focusing on gold and silver mining companies. Given current market volatility, gold is proving its value as a portfolio stabilizer, while investors may benefit from diversification and the flexibility of an active strategy to navigate the complexities of the mining sector.

Video

Why Does a Pure-Play Strategy Matter in Silver Miners?

SLVR is a silver mining and physical silver ETF that offers a pure-play strategy that allocates approximately 70% to silver-focused companies. SLVR offers investors a targeted and differentiated way to gain meaningful exposure to silver.

Shifting Energy

Safe Havens: The Enduring Stability of Precious Metals in Turbulent Times

In this episode of Shifting Energy (Season 2), Steve Schoffstall, Director, ETF Product Management and John Kinnane, Director, Key Accounts at Sprott Asset Management, chat about how investors are navigating bumpy markets and global trade wars with assets like gold and silver.

Sprott Uranium Report

Is Uranium’s Bull Market Over?

Recent market events have put pressure on uranium, but we continue to believe in the resilience and long-term bullish outlook for physical uranium and uranium mining equities. Our positive outlook is supported by uranium's growing structural supply deficit and global policy support for nuclear power.

Sprott Gold Report

The Return of Exter’s Inverted Pyramid

Gold has been rising on strong official sector demand, fueled by concerns over the U.S. dollar and global instability. While Western investors have focused on potentially overvalued stocks, gold and mining equities offer potential upside as other assets struggle.

Sprott Copper Report

Copper’s Record-Setting Rally and Reversal on U.S. Tariffs

Copper prices reached record highs in March, driven by tariff fears and U.S. demand. Despite recent market volatility, copper remains a strategic asset with strong long-term fundamentals, supported by rising global energy demands and U.S. policy shifts.

Sprott Q1 Precious Metals Report

Gold's Strength Amid a Crisis of Confidence

Gold's record-breaking rally in Q1 2025 reflects mounting investor anxiety over stagflation, policy volatility and a fraying global economic order. U.S. tariffs and policy unpredictability have elevated the risk of stagflation, fueling demand for gold as the lone liquid safe-haven asset. We also believe silver is potentially poised to break out.

Sprott Webcast Replay

A Closer Look at Gold and Silver, Metals and Miners

Gold and silver provide a powerful blend of potential wealth preservation, inflation mitigation and portfolio diversification. This webcast provides insights from John Hathaway and Maria Smirnova on the key technical drivers influencing gold, silver and precious metals mining equities.

Shifting Energy

Global Trade Wars: Unraveling the Impact on Critical Materials Markets

In this episode of Shifting Energy, Thalia Hayden interviews Steven Schoffstall, Director, ETF Product Management at Sprott Asset Management about how the global energy shift and market volatility are impacting precious metals and critical materials. Schoffstall provides valuable insights into what's happening with gold, silver, uranium and copper.

Video

Introducing Sprott Active Gold & Silver Miners ETF (GBUG)

Sprott’s Steve Schoffstall introduces GBUG, an actively managed ETF focused on gold and silver miners, using a team with deep industry expertise to identify investments. With a long-term, value-driven approach, it aims to provide exposure to precious metals while navigating market shifts.

Interview

Trump Tariffs: Disruption or Opportunity?

Are tariffs set to disrupt gold, silver and uranium markets? Find out how potential trade barriers could impact prices and create arbitrage opportunities. Kitco’s Senior Mining Editor and Anchor Paul Harris interviews John Ciampaglia, CEO of Sprott Asset Management, at the 2025 BMO Global Metals, Mining & Critical Minerals Conference.

Sprott Uranium Report

Tariffs, Tensions and the Uranium Opportunity

We see market volatility as an opportunity, with uranium’s spot price offering an attractive entry point for investors. Despite Trump tariff policy and geopolitical uncertainties, uranium’s strong long-term fundamentals—supply deficits and rising nuclear demand—remain intact.

Educational Video

The Era of Critical Materials: Powering Our Planet Toward a Brighter Future

We explore the essential minerals driving the energy revolution, from copper's role in electrification to uranium's impact on nuclear power, and the rise of battery storage technology. Join us on a journey through the periodic table to understand how these critical materials are needed to meet the rising global demand for energy.

Special Report

GBUG and The Case for Active Management

Sprott Asset Management has launched GBUG which seeks long-term appreciation through value-oriented, contrarian investing. Sprott's active management team looks to capitalize on the wide dispersion of returns within the mining sector and the potential for silver to catch up to gold's rise.

Sprott Critical Materials Monthly

Critical Materials Markets Shake Off DeepSeek Disruption and U.S. Policy Rollbacks

Critical materials showed resilience in January amid global volatility. We take a deep dive into China's growing leadership in clean technology investments, the disruptive impact of DeepSeek's AI model and the implications of U.S. policy changes on the energy transition and critical materials supply chains.

Video

Introducing Sprott Silver Miners & Physical Silver ETF (Nasdaq: SLVR)

Discover the unique advantages of Sprott Silver Miners & Physical Silver ETF (SLVR), a new ETF offering exposure to both silver miners and physical silver. With rising industrial demand and a tightening supply, SLVR provides investors with a strategic opportunity to benefit from silver’s dual role as a precious and industrial metal.

Sprott Uranium Report

Uranium Markets Trumped by Uncertainty

The uranium markets experienced volatility in January, with prices dipping despite strong miner performance. Key factors included the emergence of the Chinese AI model DeepSeek and the return of the Trump administration.

Shifting Energy

Energy’s Silver Lining: A Precious Metal Powering the Future

In this episode of Shifting Energy (Season 2), Thalia Hayden chats with Steven Schoffstall, Director, ETF Product Management at Sprott Asset Management about silver miners, investing in silver and how the silver market is tied to the global energy shift.

Interview

Uranium Outlook for 2025

Sprott CEO John Ciampaglia remains bullish on the uranium markets, citing rising term prices, increased utility interest and the global nuclear renaissance fueled by clean energy needs and AI-driven power demands. Ciampaglia expects uranium prices to strengthen as pent-up demand grows, driven by reactor life extensions, new builds and geopolitical supply disruptions.

Sprott Radio Podcast

Silver 2025

Pinch point is the term Sprott’s Maria Smirnova uses to describe the current supply-demand picture for silver in 2025. Smirnova joins host Ed Coyne to walk us through how silver’s growing demand is coming up against a static supply pipeline.

Special Report

Top 10 Themes for 2025

What forces will shape the markets in critical materials and precious metals in 2025 and beyond? We identify 10 critical macro and market themes investors should watch in the coming year.

Sprott Gold Report

Recalibrating Our Crystal Ball

Gold was a strong performer in 2024, gaining 27.22% to end the year at $2,624.50, fueled by geopolitical tensions, central bank purchases and bond market struggles. These strong gains occurred with negligible participation or interest from investors in North America or Europe. Key catalysts for a gold rally could include stock or cryptocurrency downturns, bond market disruptions or a U.S. dollar reset.

Shifting Energy

Uranium Unleashed: How Mining Stocks Fuel the Nuclear Comeback

Sprott's John Kinnane and Steve Schoffstall explore the growing opportunities in the uranium and nuclear energy markets. They discuss how pure-play uranium miners, supply-demand dynamics and shifting geopolitical policies are positioning this sector as a promising investment frontier for 2025 and beyond.

Silver Report

Silver's Impressive Strength in 2024

We believe that silver continues to offer a compelling investment opportunity due to its unique market dynamics. For investors, a diversified portfolio that balances physical assets and mining equities may offer exposure to silver's stability as a store of value and its growth potential as a critical industrial metal.

Special Report

The Uranium Miners Opportunity

We believe uranium mining equities are poised for growth as demand for nuclear power increases, driven by AI data center needs and electricity demand. Geopolitical shifts, such as Russia’s export restrictions, and global pledges to triple nuclear capacity by 2050 highlight supply chain importance. This creates a compelling case for uranium miners, which are supported by strong market fundamentals.

Sprott Uranium Report

Uranium Markets Impacted by Market Signals and Uncertainty

The uranium market remains strong despite recent spot price declines, with tight supply, rising demand and long-term fundamentals driving a bullish outlook. Global support for nuclear energy is growing, with ambitious commitments to triple capacity and junior miners playing a key role in addressing supply deficits.

Insights

Sprott ETFs 2024 Year-End Distributions

This is not intended to be a statement for official tax reporting purposes or any form of tax advice. If you have any questions, please call 888.622.1813 between 9:00 AM and 5:30 PM ET, Monday through Friday.

Interview

Nuclear Power and Critical Materials: A Post-Election Outlook

What’s the potential impact of the incoming Trump administration on nuclear power, clean energy and critical materials? Thalia Hayden of ETFguide talks with John Ciampaglia about what potential changes may be on the horizon for U.S. energy policies and some strategies for investment portfolios.

Interview

Real Assets in Focus: Gold, Silver, Copper and Uranium

Unlock the power of real assets investing with Sprott’s Masterclass video. Dive into gold, silver, copper and uranium with industry experts Ed Coyne, Ryan McIntyre and Steve Schoffstall as they reveal strategies to navigate global uncertainties and identify opportunities. Discover how to leverage precious metals and critical materials to potentially build a resilient, future-ready portfolio.

Sprott Critical Materials Monthly

Batteries and Minerals Driving Global Electrification

Batteries and energy storage continue to underpin electrification trends, solidifying their role as a cornerstone in the global shift toward sustainable energy. Support is being strengthened by strategic investments from governments and corporations, and resilient demand for critical minerals like lithium, copper and nickel.

Interview

Why Tech & Big Investors Are Turning to Uranium & Gold

John Ciampaglia, CEO of Sprott, joins James Connor to discuss why gold is increasingly viewed as a safeguard against economic uncertainty and why uranium has become essential to powering big tech's ambitious AI expansion.

Shifting Energy

The New Power Play: How Tech Giants Are Embracing Nuclear Energy for Data Centers

Nuclear power is creating a buzz in media circles. Thalia Hayden of @etfguide talks with John Ciampaglia about the powerful comeback of nuclear energy and how tech giants are embracing nuclear energy for data centers.

Sprott Uranium Report

Big Tech Targets Nuclear Energy to Support AI Ambitions

Big tech is turning to nuclear energy to fuel the massive power needs of AI-driven data centers. They're striking bold deals to develop small modular reactors (SMRs), sparking a surge in uranium demand and helping to support clean energy innovation. At the same time, global uranium supply remains inadequate to meet both current and future reactor requirements.

Sprott Q3 Precious Metals Report

Gold and Silver Enjoy Continued Rally

Gold and silver prices surged in Q3 2024, driven by central bank buying and macroeconomic factors. While gold experienced a historic price increase, silver's price was influenced by both its precious metal value and industrial demand. YTD through September 30, gold is up 27.71% and silver has gained 30.95%.

Sprott Critical Materials Monthly

U.S. Electricity Grid Remakes Itself to Meet Surging AI-Led Power Demand

Demand for electricity over the next decade will put pressure on the U.S. power grid to keep pace. New investment in power-hungry industrial facilities is driving demand, especially the data centers that support artificial intelligence (AI), U.S. reshoring initiatives and the steady electrification of the transport sector.

Sprott Webcast Replay

Investing in Critical Materials: A Diversified Approach to a Long-Term Opportunity

In our webcast with Nasdaq, John Ciampaglia discusses the rapid emergence of technologies like AI, the race to upgrade power grids, continuing global decarbonization goals and growing middle classes. He gives an overview of how the critical materials behind energy—such as uranium, copper, nickel, lithium and more—are likely to remain growth-oriented investment opportunities for the long term, and how to invest in them in a single allocation.

Sprott Uranium Report

Uranium Markets Shake Off Summer Doldrums

The uranium market has faced short-term volatility, including price declines driven by geopolitical tensions and economic concerns. Despite these challenges, the long-term outlook remains strong. Supply uncertainties from key producers like Kazakhstan and Russia are contributing to this volatility, but the fundamental supply-demand imbalance suggests further growth potential.

Shifting Energy

The Fourth Industrial Revolution: Reshaping Global Energy Markets

Sprott's Steve Schoffstall discusses how AI, robotics and quantum computing are integrating into the overall global economy and how these developments will reshape the global energy landscape. Learn about electricity production and technological innovation and how to invest in the opportunities they provide.

Shifting Energy

An Inside Look at the Global War for Lithium, Copper and Critical Minerals with Author Ernest Scheyder

Author and acclaimed Reuters journalist Ernest Scheyder discusses his book, The War Below: Lithium, Copper, and the Global Battle to Power Our Lives, with Sprott's Steve Schoffstall in this exclusive interview.

Sprott Critical Materials Monthly

The Unstoppable Rise of Renewable Energy

Renewable energy is rapidly replacing fossil fuels as costs decrease and efficiencies improve with increased deployment, making it much cheaper than traditional energy sources. This shift, driven by the exponential growth of renewables, electrification, and efficiency, is expected to significantly alter global power dynamics as fossil fuels are phased out.

Special Report

The AI Revolution and Data Centers: A New Frontier in Energy Demand

Significant investments in AI-related tech stocks have helped push the S&P 500 Index to record highs this year. The rapid growth of AI is significantly increasing the energy demands of data centers, which is likely to lead to a surge in demand for critical materials.

Special Report

Lithium: Short-Term Opportunities for a Long-Term Trend

This might be an ideal moment to re-evaluate lithium miners given their potential to benefit as the global energy transition continues. The current dip in the price of lithium miners presents a potential short-term opportunity, given the strong future demand and supply imbalance.

Sprott Uranium Report

Uranium Case Strengthens

The uranium spot price has remained range-bound between $85 and $95 per pound, and ended the first half at $85.34 (June 30, 2024). Uranium miners fell in June, but bounced back in early July, outperforming the commodity YTD. Over the longer term, physical uranium and uranium miners have demonstrated significant outperformance against broad asset classes, particularly other commodities.

Sprott Q2 Precious Metals Report

Gold’s Record-Setting Quarter and Silver’s Resurgence

Gold has been on the move since Q2 ended, after having gained 12.79% year-to-date as of June 30, gold's best six-month start since 2020. Gold enjoyed strong support from central bank buying. Silver closed Q2 at $29.14, its highest quarterly close since Q3 2012. Silver was supported by the gold breakout and global monetary expansion policies.

Sprott Critical Materials Monthly

Fourth Industrial Revolution Fuels Global Competition for Critical Minerals

The world is in the midst of a fourth industrial revolution (4IR) as technological developments like artificial intelligence (AI), robotics, IoT, genetic engineering and quantum computing bring about an unprecedented integration of the digital, physical and biological realms. Electrification and energy are pivotal to advancing 4IR technologies, and the resulting demand pressures on critical minerals like copper, lithium and uranium are supporting a new commodity supercycle.

Shifting Energy

Copper and AI: Understanding the Opportunity for ETF Investors

In this episode of Shifting Energy (Season 1), Thalia Hayden of @etfguide talks with John Ciampaglia, CEO of Sprott Asset Management, about the growing energy requirements of AI and how uranium, copper, silver and other metals may benefit.

Shifting Energy

Uncovering Big Opportunities and Demand in Nickel for Investors

In this episode of Shifting Energy (Season 1), Thalia Hayden of etfguide talks with Steve Schoffstall, Director of ETF Product Management at Sprott Asset Management, about the nickel growth story, what's driving it and the investment opportunities now and ahead.

Interview

Gold Outlook with John Hathaway

What will take the gold price higher? John Hathaway, Senior Portfolio Manager, provides his thoughts on why gold isn't moving and what will take it higher.

Sprott Uranium Report

Uranium Miners Lead Market Higher

Thus far in 2024, the uranium spot price has stabilized between $85 to $95 per pound after a significant 88.54% increase in 2023. This phase indicates a healthy correction within a bullish market cycle. Uranium miners have shown improved performance, catching up to gains in the spot price.

Sprott Critical Materials Monthly

A New Copper Supercycle Is Emerging

The copper market is entering a new supercycle, built on several rising geopolitical and market trends contributing to a strong bullish outlook. Demand is surging as countries invest in clean energy and protect their access to copper, while supply is constrained by a lack of new mine development.

Sprott Silver Report

Silver’s Critical Role in the Clean Energy Transition

Silver is a critical player in the global shift toward cleaner energy. Solar panels and EVs, both essential for curbing greenhouse gas emissions, rely heavily on silver. Other new technologies, including AI, have also sparked demand for silver, while overall silver supply has declined.

Sprott Webcast Replay

Gold and Silver: Precious Metals On the Move

Replay our webcast, focused on gold and silver, and featuring John Hathaway and Maria Smirnova. Gold is enjoying strong support from central bank buyers like China, and silver is benefitting from increased demand for PV solar panels.

Sprott Critical Materials Monthly

AI's Critical Impact on Electricity and Energy Demand

The rise of AI and data centers is likely to significantly increase global electricity demand, creating challenges for power grids but also opportunities for stable, clean energy sources like nuclear power. AI data centers are also likely to support increased demand for copper.

Special Report

The Case for Investing in Nickel Miners

Nickel's future looks promising due to its role in achieving net-zero emission goals. Stricter regulations and government support for electric vehicles are driving up demand for nickel, which will benefit nickel mining companies in the long run. Nickel-intensive batteries are also increasingly being used in large-scale energy storage systems that employ thousands of NMC batteries to power renewable energy projects.

Special Report

Nuclear Revival: A Resurgence for Uranium Miners

Rising global commitments to nuclear energy are helping to make uranium a compelling investment. While spot uranium prices have come down slightly after a significant rise, we believe there is room for growth given that demand is expected to climb as the need for low-carbon energy sources intensifies. We believe that uranium miners can add growth potential and diversification to investor portfolios.

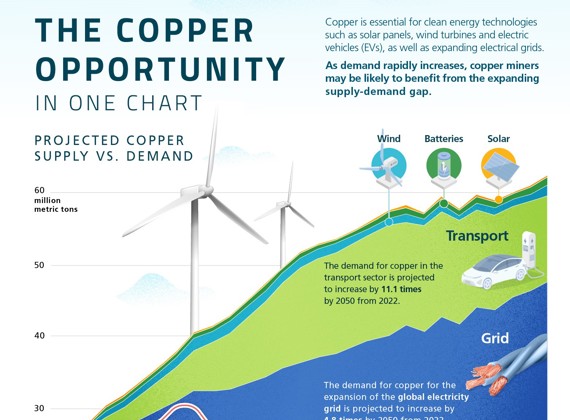

Infographic

The Copper Opportunity in One Chart

As the world embraces clean technologies, the search for and expansion of copper mines will be essential. Early investors who gain exposure to copper mines may benefit from the rapidly increasing demand.

Sprott Uranium Report

Miners Ignore Softer Uranium Price

The uranium market showed mixed performance in March: the spot uranium price fell but miners' stocks rose due to long-term positive outlook for uranium demand. With no meaningful new supply on the horizon for three to five years, we believe the uranium bull market has further room to run.

Sprott Critical Materials Monthly

Battery Storage Is the Technological Cornerstone for a Sustainable Energy Future

The energy sector has experienced a remarkable transformation, primarily driven by the rapid growth and integration of renewable energy sources. Central to this transition is the advancement of battery storage technology, a critical enabler that promises to reshape how we generate, distribute and consume electricity. As we examine this evolving landscape, it becomes evident that battery storage is a technological cornerstone for a sustainable energy future.

Sprott Q1 Precious Metals Report

Gold Is on the Rise and Reaches All-Time High

Gold reached an all-time closing high and is up 8.09% YTD (as of 3/31/2024) after rising 13.10% in 2023. We believe several fundamental factors are in place for gold to move higher, in particular, strong central bank buying. We also see three drivers for a higher silver price: 1) silver tracks rising gold due to central bank buying, 2) reflation trade and 3) increased solar panel demand.

Shifting Energy

The Copper Growth Story

In this episode of Shifting Energy (Season 1), Thalia Hayden @etfguide talks with Ed Coyne, Senior Managing Partner and Steve Schoffstall, Director of ETF Product Management at Sprott Asset Management about the copper growth story, what's driving it and the investment opportunities now and ahead.

Interview

The Elements of Energy: Uranium and Copper

Learn how renewed interest in nuclear power, rising global energy demands, and the transition to clean energy are driving investment opportunities in uranium, copper and their miners.

Sprott Webcast Replay

Uranium and Copper: The Elements of Energy

Electricity demand is expected to grow 86% by 2050. At the same time, most of the world is committed to seeking zero-carbon emissions and increasing nuclear energy capacity. At the center of this growth and transformation are uranium and copper – two critical materials that are in high demand and limited supply. These materials and their miners are potentially attractive investment opportunities.

Sprott Radio Podcast

Nickel: The Hidden Metal

Used in far more than just coins today, nickel is the hidden metal that’s everywhere in our modern world. To walk us through its fascinating story, Ed Coyne is joined by Gary Coates from The Nickel Institute.

Sprott Uranium Report

Uranium Bull Market Takes a Healthy Pause

Uranium markets pulled back in February after a rapid rise—in our view, this is a healthy pause in the ongoing uranium bull market. Announcements from Kazatomprom and Cameco underscored the uranium markets' structural supply deficit, while global governments continued to champion the benefits of nuclear energy.

Interview

Nasdaq TradeTalks: How the Demand for Copper Could be Impacted by the Transition to Cleaner Energy

Steve Schoffstall visits Nasdaq TradeTalks to talk about Sprott’s continued expansion in the critical minerals sector, including the launch of Sprott Copper Miners ETF (COPP). Steve touches on the demand for copper in the ongoing global energy transition and what it means for the copper market overall.

Interview

Nasdaq Investment News: Copper and its Role in the Transition to Cleaner Energy

Ed Coyne stops by Nasdaq Investment News to discuss copper’s role in the energy transition, its current status in the market and how Sprott is capturing the potential opportunity with the Sprott Copper Miners ETF (COPP) and the Sprott Junior Copper Miners ETF (COPJ).

Sprott Critical Materials Monthly

Global Investment Pours into Renewable Energy

February was a lackluster month for critical materials, but the backdrop remains very positive. The global commitment to clean energy hit a new milestone in 2023 as investment in energy transition surged to an unprecedented $1.77 trillion, led by electrified transport. Over the past 10 years, investment in global energy transition has grown at a 24% compound annual rate, several times the global GDP growth rate.

White Paper

A New Era: How Critical Minerals Are Driving the Global Energy Transition

Critical minerals are essential for the global energy transition as we gradually phase out CO2-intensive energy sources with cleaner sources, including nuclear, solar, wind, hydro and geothermal energy and greater use of electric vehicles (EVs). We believe the unique supply and demand dynamics for critical minerals will underpin potential investment opportunities in the years ahead.

Shifting Energy

The Nuclear Energy Comeback and Uranium Powering It

John Ciampaglia, CEO of Sprott Asset Management, joins Thalia Hayden on Sprott’s new video series, Shifting Energy. They discuss surging uranium prices, the latest nuclear renaissance and potential investment opportunities. The series was created in partnership with ETF Guide to keep viewers on top of energy transition investment opportunities.

Sprott Radio Podcast

All Eyes on Uranium Part 2

Per Jander from WMC is back for Part 2 of our All Eyes on Uranium series. Per and host Ed Coyne discuss the recent production guidance announcements from Kazatomprom and Cameco and the overarching issue of the structural supply deficit in uranium.

Special Report

Copper: Wired for the Future

The demand for copper in energy grids, electric vehicles and clean energy technologies, combined with diminishing ore grades and limited inventories, underscores copper's growing importance. We believe copper prices and miners are likely to benefit from the growing supply-demand gap.

White Paper

Copper: The Red Metal's Central Role in Powering Our Net-Zero Carbon Future

Today, in the United States alone, copper is a crucial element in nearly 7 million miles of electrical transmission and distribution wires. This white paper introduces the trends that are driving copper markets and copper miners, and explains our positive outlook for growth.

Sprott Uranium Report

Uranium Price Returns to Triple Digits

Uranium price surged 11% in January to $101 per pound, fueled in part by Kazatomprom's cut in guidance for 2024 production by ~14%. Junior uranium miners were top performers for the month, climbing 18.78%. Supply uncertainties continue to dominate markets, given the situation in Niger and possible bans on Russian uranium.

Sprott Critical Materials Monthly

The Emerging Renewable Energy Economy

A significant transition is underway in global energy production. The era of renewable energy is emerging and beginning to reshape power generation. Recent trends suggest that this shift is no fleeting phenomenon but a fundamental transformation powered by the relentless fall in renewable energy costs. The world is investing heavily in renewables. Some 62% of total global energy investment is now directed to clean energy.

Infographic

Nine Critical Energy Minerals For Investors

Low carbon energy technologies are driving increasing demand for minerals critical to the energy transition.

Sprott Radio Podcast

All Eyes on Uranium Part 1

Per Jander joins host Ed Coyne for the first of a series of podcasts covering all the latest developments in uranium. Part 2 will be recorded and released after the upcoming announcements from Kazatomprom and Cameco in early February.

Interview

Sprott is Bullish on Uranium as Governments Shift to the Energy Source

John Ciampaglia, CEO of Sprott Asset Management, sits down with Andrew Bell of BNN Bloomberg to discuss the uranium market and Sprott’s growth in the space. Campaglia: "We’ve been very active in educating the market and investors about the uranium thesis since we acquired the Uranium Participation Corporation in July of 2021."

Special Report

Top 10 Themes for 2024

What forces are likely to drive energy transition materials and precious metals markets in 2024 and over the next decade? We discuss 10 critical macroeconomic and market-specific themes ranging from deglobalization and climate policy to the new commodity supercycle and a potential silver price breakout.

Educational Video

Nuclear Waste: Dispelling Fears and Myths

Nuclear waste is not something to be feared. The care with which it is handled and stored contributes to the fact that nuclear power is one of the safest forms of baseload energy generation known to humanity. In this video, we dispel the many fears and concerns about spent nuclear fuel.

Sprott Outlook

What a Year for Uranium and Nuclear Energy

2023 provided the long-awaited inflection point for the uranium contracting cycle whereby we have finally achieved replacement rate levels. We believe the era of uranium inventory destocking and utility complacency is over. Long-term security of supply concerns, fanned by lingering geopolitical risks and the challenges of expanding primary production, are likely the key themes to watch.

Interview

Sprott Energy Transition ETFs

The Sprott Energy Transition ETFs are a suite of ETFs designed with the potential for revenue and asset growth by investing in the miners of critical minerals that enable clean energy generation, transmission and storage: Lithium, Uranium, Copper, Nickel and several others.

Sprott Radio Podcast

The Lowdown on Uranium Demand

Justin Huhn, founder of Uranium Insider, joins host Ed Coyne for a deep analysis of the uranium fuel supply chain and the challenges to satisfy expanding demand. "This year alone, demand is around 200 million pounds and supply is about 160 million pounds. That means we're about 40 million pounds short."

Sprott Uranium Report

Uranium & Nuclear Get Boost from COP28

The U3O8 uranium spot price broke through $80 per pound, gaining 8.39% in November and is up 67.10% YTD; uranium stocks followed suit. COP28 was dubbed the "nuclear COP" in recognition of nuclear power's increasing importance and a growing awareness of a uranium supply-demand gap.

Sprott Critical Materials Monthly

Lithium-Ion Technology Solidifies Lead in EV Battery Stakes

The long-term trajectory for EVs is positive despite the recent slowdown. The EV industry is navigating the typical challenges of early technology adoption, with continuous investments and technological advancements driving the transition to electrification. Lithium-ion batteries (LIBs) are the preferred battery technology for EVs, thanks to their superior technical properties and significant investment in their development and infrastructure.

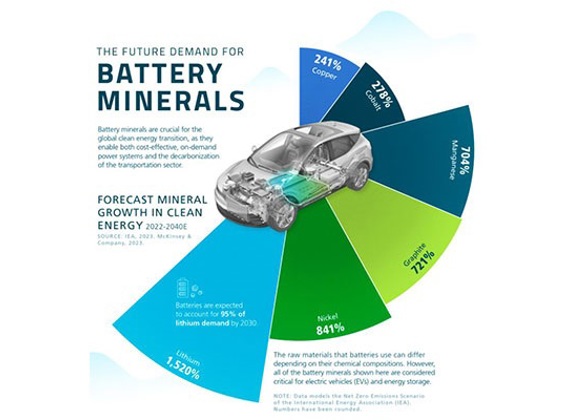

Infographic

The Future Demand for Battery Minerals

Battery metals are expected to account for 95% of lithium demand by 2030. Battery minerals are crucial for the global clean energy transition, as they enable both cost-effective, on-demand power systems and the decarbonization of the transportation sector.

Infographic

The Global Uranium Market in 3 Charts

The uranium market is experiencing increased demand, driven by its integral role in clean energy generation through its use in nuclear power.

Interview

Uranium Market Outlook 2024

Per Jander and James Connor discuss the uranium market, highlighting the catalysts for sharp increases in uranium prices in 2023, including increased utility and producer activity, production shortfalls from major players like Cameco and Orano, and geopolitical uncertainties affecting supply. Per Jander expresses optimism for the uranium market, emphasizing strong demand, ongoing long-term contracting discussions and potential supply disruptions as factors that could contribute to further price increases in 2024.

Sprott Uranium Report

Higher Uranium Prices Allow Miners to Resume Production

The uranium price increased in October, reaching a 12-year high at $74.48 per pound. Although uranium mining stocks pulled back last month, the stronger uranium price has boosted producer revenues and the potential for mine restarts and new developments. A growing supply deficit is helping to support higher price levels as the West focuses on reshoring supply chains.

Sprott Radio Podcast

Battery Materials Deep Dive

Daisy Jennings-Gray from Benchmark Minerals Intelligence joins host Ed Coyne for a deep dive into today’s battery metals markets.

Sprott Critical Materials Monthly

Energy Security and the Shifting Focus from Oil to Critical Minerals

As the United States advances in its pursuit of clean energy, it is strategically redirecting its energy security emphasis from oil to critical minerals. This dynamic shift is designed to decrease reliance on oil, and diminish the influence of oil geopolitics and the sway of petrostates such as Russia.

Interview

Uranium Rally in Early Innings, Sprott Asset Management CEO Suggests

John Ciampaglia, CEO of Sprott Asset Management joins CNBC Fast Money to talk about the uranium market and share Sprott's views on the benefits of nuclear energy and the need for energy security.

Interview

The Energy Transition to Uranium and Battery Metals

Ed Coyne, Senior Managing Partner, sits down with Gillian Kemmerer of Asset TV to discuss the energy transition to uranium and other battery metals, and what investors should take into consideration in this space. He also shares Sprott's outlook on gold.

Sprott Precious Metals Report

Central Banks Support Gold & Solar PV Demand Buoys Silver

Despite a pullback on gold investments, demand from sovereigns and central banks remains unwavering. Over the past decade, China has been committed to bolstering its gold reserves to enhance its economic and geopolitical standings. Silver is likely to be in high demand as the energy transition expands, given it is critical to solar PV panel technology, EV batteries and 5G cellular service.

Sprott Critical Materials Monthly

Silver Demand Grows as Solar Leads Renewables

Uranium's performance helped the energy transition complex close higher in September. From a macro outlook, solar panels are emerging as a critical player in the global energy transition. Evolving technologies in renewable energy, especially in the solar space, are driving a surge in silver demand which may likely outpace supply over the next decade.

Interview

Rethinking Energy Exposure with Mineral and Mining ETFs

The global transition to clean energy is driving demand for critical minerals like uranium, copper and battery metals such as lithium and nickel. These minerals are crucial for nuclear power, electric vehicles, wind, solar, and hydropower.

Sprott Radio Podcast

Take What You Can Get

With demand for nuclear fuel growing and supply facing challenges, the prevailing sentiment at the recent World Nuclear Symposium in London was “take what you can get.” Just back from the event, John Ciampaglia and Per Jander join host Ed Coyne to update us on the full story.

Sprott Uranium Report

Uranium Rally Gains Power in September

Uranium and uranium mining stocks posted their best month in two years, as the price of U3O8 reached a 12-year high. YTD as of 9/30/23, physical uranium has risen 51.88% and uranium mining equities have gained 23.93%. Positive sentiment toward nuclear power is growing, and the WNA estimates that uranium demand will double by 2040. Western nations are strategically maneuvering to reduce their dependence on Russia for both uranium supplies and related services.

Video

How the Uranium Market Works

Per Jander, WMC Technical Advisor to Sprott Physical Uranium Trust, draws upon his years of experience as a uranium trader to reveal how the market works. Who are the buyers and sellers, how is uranium transacted and how will the market evolve moving forward? Per answers these questions and more to give investors a better understanding of the dynamics of the uranium trade.

Special Report

Pro-Nuclear Sentiment Ignites Uranium Opportunities

The global nuclear power industry is experiencing a revival. Geopolitical events and a surge in energy demand have shifted sentiment positively, with countries investing in new nuclear reactor builds, restarts and extensions. This has created a growth opportunity for uranium miners, especially as the uranium supply is facing challenges in meeting current and future demand.

Sprott Webcast Replay

The Great Power Shift: Uranium, Battery Metals and the Energy Transition

The clean energy transition and worldwide energy security goals are fueling a global power shift. This shift has reignited interest in nuclear power, accelerated electric vehicle (EV) adoption and spurred renewable energy deployment. In this environment, uranium, lithium, copper and other high-demand, short-supply critical minerals are vitally crucial — and potentially attractive as investment opportunities.

Sprott Uranium Report

Strong Fundamentals Anchor Uranium's Rise

Uranium and uranium mining stocks had a strong month in August. YTD as of 8/31/2023, spot uranium and uranium mining stocks have climbed 25.49% and 21.52%, respectively, outperforming the frothy S&P 500 TR Index's YTD return of 18.73%. We believe the uranium bull market is intact and favorable supply-demand dynamics will likely continue to provide support.

Sprott Critical Materials Monthly

U.S. Taking Center Stage in Cleantech Investment

Uranium had a strong month in August, contrasting with the decline of most energy transition metals due to China's economic troubles and shadow banking woes. The investment capital spurred by the U.S. Inflation Reduction Act (IRA) is turning the U.S. into a cleantech powerhouse, reshaping global economics. The old China-led commodity supercycle is giving way to a new U.S.-based supercycle focusing on clean energy and innovation.

Special Report

Electric Vehicles and the Growing Opportunity for Lithium Miners

Electric vehicle (EV) adoption has surged in recent years, creating unprecedented demand for lithium, a critical component of EV batteries. With lithium demand expected to rise substantially in the years ahead, lithium miners are at the nexus of the global EV transformation.

Sprott Radio Podcast

The Great American Nuclear Renaissance

With the introduction of the Inflation Reduction Act, US policy makers have reset the landscape for nuclear energy. Ed is joined by Benton Arnett from the Nuclear Energy Institute to walk us through the details.

Sprott Uranium Report

Stars are Aligning for Uranium and Nuclear Energy

Uranium continued to outshine other commodities, with U3O8 surging 16.35% and uranium miner stocks climbing 9.11% YTD as of July 31, 2023. The growing embrace of nuclear energy is driving demand and sparking a resurgence in uranium mine operations. The U.S. opened its first new nuclear power facility in 30 years (Georgia Power's Plant Vogtle) and is actively legislating to reduce dependency on Russia's nuclear supply chain.

Sprott Energy Transition Materials Monthly

Growing Urgency to Modernize U.S. Power Grid

Given increased electricity demand and the risks posed by climate change, the U.S. power grid desperately needs modernization. There is an immediate need to expand the grid’s capacity, increase its resilience and support its most vulnerable components – the transmission and distribution lines. This is driving the development of energy storage systems and V2G (vehicle-to-grid) technology and is a major copper demand driver.

Interview

Investment Opportunities in the Energy Transition

John Ciampaglia discusses the energy transition on Nasdaq Trade Talks with host Jill Maladrino. Ciampaglia explores transformative investment opportunities in the energy transition, from the explosive growth of EV battery materials to the resurgence of nuclear energy. Discover how the shift toward decarbonization and critical mineral supply chains is fueling long-term market potential.

Sprott Precious Metals Report

Central Banks Flex Gold Market Muscle

In the first half of 2023, the gold bullion price rose by 5.23% despite competition from a euphoric equity market. Even with contrasting approaches, central banks and investment funds became the main players shaping the gold market in the first half of the year. Central bank buying drove demand, and gold is reverting to its historical role as a significant reserve asset as central banks seek to diversify amid geopolitical uncertainties.

Sprott Radio Podcast

Where Will the Gigafactory Feedstock Come From?

Joe Lowry, aka Mr. Lithium, joins Ed Coyne to walk us through all things lithium, including where ”Elon's first principle's rhetoric falls off the side of the table”.

Educational Video

Copper: The Essential Power Player in the Energy Transition

As the world seeks to reach net-zero targets and transition to cleaner, renewable forms of energy, copper is a requirement—but the amount of copper needed to successfully facilitate the energy transition is staggering. Learn about this critical mineral, its uses and how copper miners may be well positioned to benefit from increased investment in the low-carbon and renewable energy sector.

Sprott Uranium Report

Supply-Demand Gap Ignites Uranium Rally

Uranium markets rallied in June with the U3O8 uranium spot price adding 2.61%. U3O8 has climbed a healthy 15.95% YTD, while most other commodities have lost ground. Greater focus on the uranium supply-demand gap helped boost uranium mining stocks in June, with junior miners up 18.88%. Positive momentum in reshoring supply chains continues, given looming sanctions on Russian uranium.

Sprott Critical Materials Monthly

EV Battery Independence and the New U.S. Manufacturing Supercycle

Energy transition metals miners posted strong results in June, with uranium mining equities leading the group. The U.S. is entering the early stages of a manufacturing supercycle driven by massive energy transition investment, which includes building a secure and resilient domestic EV battery supply chain. The U.S. and EU are likely to replace China as the primary drivers of future metals demand, as China's two-decades-long commodities dominance has likely crested.

Special Uranium Report

Key Facts about Spent Nuclear Fuel

Chemical reactions of fossil-fuel plants release more radiation into the environment than the operation of nuclear energy plants — 10 times more. Most nuclear-industry waste is relatively low in radioactivity, and only a small amount is produced. Estimates put the total waste from a nuclear reactor supplying one person's electricity needs for a year at the size of a standard brick.

Sprott Radio Podcast

Uranium Update from Per's Cabin

Just back from the World Nuclear Fuel Market 49th Annual Meeting, Per Jander joins Ed Coyne for an update on uranium markets. The theme was “Mind the Gap”, not a nod to the London Underground but rather the pressing need for increased uranium production as countries ramp up nuclear power capacity.

Sprott Uranium Report

Uranium Remains Resilient, While Threats of Nationalism Rattle Equities

The U3O8 uranium spot price gained 1.58% in May,* increasing from US$53.74 to $54.59 per pound as of May 31, 2023. Uranium has posted a healthy 12.99% year-to-date return as of May 31, and continued to show strength and diversification relative to other commodities, which declined 13.16% YTD (as measured by the BCOM Index).

Sprott Precious Metals Report

Geopolitical Risks Enhance Gold’s Role as a Reserve Asset

Gold attempted to breakout above $2,050 in early May before drifting lower as the U.S. debt-ceiling drama deepened and the U.S. dollar strengthened. At the same time, global central banks have been accumulating gold at a record pace. This highlights gold's role as a neutral reserve asset that has the potential to mitigate increasing counterparty risks amid escalating geopolitical tensions.

Sprott Critical Materials Monthly

The West Moves to Weaken China's Hold

Lithium and lithium miners staged a sharp rebound rally in May and were the positive exception among critical minerals. The sector was weighed down by China's faltering recovery, ongoing global growth concerns and the U.S. debt ceiling drama. China’s dominance in critical minerals poses risks to the West’s manufacturing base and national security, highlighting the need for onshoring and friend-shoring energy transition supply chains.

Interview

BENZINGA: Steve Schoffstall Discusses Uranium and Energy Transition ETFs

Sprott’s Steve Schoffstall joins Benzinga’s Michael Murray and Anne-Marie Baiynd to discuss uranium, lithium and Sprott’s energy transition ETFs—including URNM, URNJ and LITP on Benzinga’s State of the Markets: ETF Capital Insights.

Sprott Precious Metals Report

Gold Rides Higher on Recession Fears

The gold market continues to be bullish as the probability of a recession rises, regional banking stress resurfaces and the Fed seems determined "get inflation down to 2%, over time". Globally, we are entering a more challenging period featuring subpar economic growth, increasing risks to systematic financial stability, stubbornly high inflation and rising geopolitical risks. Against this backdrop, we believe gold should perform well, even if the U.S. debt ceiling disaster is averted.

Sprott Critical Materials Monthly

Nationalization and Surging M&A Highlight Secular Strength

The long-term secular growth outlook for energy transition materials got several boosts in April, despite tepid performance for the month. Chile's decision to nationalize its lithium reserves reinforces the metal's role as a global strategic economic asset. M&A activity has heated up in the copper mining sector with lofty bids, including Glencore's $23 billion rejected offer for Teck Resources at a 20% premium.

Sprott Uranium Report

Uranium’s April Breakthrough

The U3O8 uranium spot price climbed 6.01% in April, closing the month at $53.74. The U3O8 price reacted positively to China's bullish comments about its ambitious plans to expand its nuclear energy capacity to supply 18% of its electricity needs by 2060, up from 5% today. YTD, the uranium spot price has gained 11.24% as global acceptance of nuclear energy increases and positive momentum builds within the uranium industry.

Sprott Radio Podcast

Hello Copper!

Host Ed Coyne and Nick Pickens from Wood Mackenzie discuss the bullish outlook for copper in 2023. Copper is key to electrical power generation and transmission, and sits at the center of the energy trilemma: the challenge of balancing cost, sustainability and security of supply.

Sprott Critical Materials Monthly

How Deglobalization is Changing the Dynamics of Securing Critical Minerals

Commodity prices weakened in March in reaction to financial system stress and recession fears. As deglobalization accelerates, unfettered access to critical minerals is not likely to last. The old system of free and fair access to commodities, including critical minerals, is moving toward one marked by interregional competition, and unstable availability and pricing. China has moved aggressively to acquire critical minerals in the past 20, but we believe the West has near-unmatched capabilities and is a formidable competitor.

Sprott Uranium Report

Uranium Proves Resilient in March

The U3O8 uranium spot price fell slightly in March, from $50.85 to $50.70. YTD through 3/31/2023, uranium has gained 4.93%, demonstrating resilience relative to other commodities (down 6.47% as measured by the BCOM Index). Along with other equities, uranium mining stocks fell in March, victims of the selloff following the U.S.'s biggest banking crisis since 2008. Positive headlines on nuclear power restarts continued in March.

Sprott Precious Metals Report

Gold Bulls Run Faster as Fed Tackles Banking Crisis

In March, gold posted its highest monthly close since July 2020 and rounded out a solid Q1 2023 gain of 7.96%. Gold is now up 21.38% from last autumn's low (9/26/22) following the most aggressive central bank purchases in decades and gold investment flows catalyzed by the U.S. banking crisis. We are very optimistic given that many significant long-term bullish macro factors for gold have become stronger, while some shorter-term cyclical gold bearish factors have faded.

Sprott Radio Podcast

Phone A Friend - How Uranium is Bought and Sold

Treva Klingbiel of TradeTech and Per Jander at WMC Energy join Sprott's Ed Coyne to discuss the inner workings of uranium pricing and contracts, the future of nuclear energy generation capacity and the development of SMRs.

Educational Video

Nickel: A Battery Metal Powering the EV Revolution

As the world moves towards cleaner forms of energy to achieve net zero emissions targets, the critical minerals and metals needed to reach those goals are stepping into the limelight. Nickel is one of these critical minerals. It is essential for the batteries used in electric vehicles, which are becoming more popular by the day as vehicle manufacturers and consumers embrace the EV revolution and countries add incentives or build in legislation supporting their adoption.

Sprott Critical Materials Monthly

Has the Next Commodities Supercycle Begun?

February saw energy transition materials/critical minerals markets correct, but the secular story remains strong. As the global energy transition "arms race" heats up, the drive to secure supply is fast becoming more important than price. All signs indicate the 40-year bond bull market has likely ended and the next great secular bull market in commodities has begun.

Sprott Uranium Report

Uranium‘s Mixed February

Although markets in February saw a reversal of January's positive performance, spot uranium posted a slight gain of 0.20%, outperforming many other asset classes. Uranium miners made headlines with significantly-sized uranium contracts that reflect higher demand for long-term supply commitments. Uranium market fundamentals are the most positive in over a decade and are likely to continue to be the primary performance driver.

Sprott Precious Metals Report

First Gold Dip Since Central Bank Buying Spree

Gold fell in February, closing the month at $1,827 in a correction characterized by a stall in buying, but not selling. Since gold's autumn 2022 low of $1,622, global central banks have been buying gold at record rates; more than three times their long-term averages. The current scale of central bank buying is massive — an annualized rate of 1,724 tonnes vs. an average of 512 tonnes over the past decade. Central bank gold purchases as a percentage of global gold demand have also tripled to 34% from their average of 11% over the past several years.

Interview

Bloor Street Capital Nuclear and Uranium Conference

John Ciampaglia: “I think it's an interesting time to be investing in uranium — from a fundamental perspective, from an energy policy perspective, from a geopolitical risk perspective….we've experienced a sea change in the level of interest related to uranium, energy transition materials and mining investments.” Bloor Street Capital's Nuclear and Uranium Virtual Conference featured John Ciampaglia, CEO of Sprott Asset Management, and Per Jander, WMC Energy, Director, Nuclear & Renewables.

Sprott Webcast Replay

The Energy Transition Is Here. Is Your Portfolio Ready?

As the world sets aggressive goals to reduce reliance on fossil fuels and move to cleaner energy sources, critical minerals will be essential. Due to years of underinvestment, we believe demand is likely to outstrip supply for many energy transition materials, including uranium, lithium, copper, nickel and others. The investment opportunities may be powerful.

Sprott Critical Materials Monthly

Critical Materials Start 2023 With a Bang

We believe we are in the early stages of an energy transition materials secular bull market and favorable supply-demand dynamics are likely going forward. The upward revision in global growth, the timing effect of the China credit impulse and the surprise ending of China's zero-COVID policy have provided a tailwind for the metals market. For energy transition metals, we see this as a cyclical boost on top of the robust secular demand that is in play.

Sprott Uranium Report

Uranium‘s January Jump

January was a strong month for uranium markets, with U3O8 uranium spot price posting a 5.05% increase and uranium mining equities gaining 14.65%. Looking ahead, we believe the uranium bull market still has a long way to run. Over the long term, increased demand in the face of an uncertain uranium supply is likely to support a sustained bull market.

Interview

Fireside Chat: Investing in the Critical Minerals Driving the Energy Transition

A global clean energy transition is underway. Significant investment in energy infrastructure will be required over the coming decades as we evolve how we generate, transmit and store energy. Critical minerals will be essential. We believe investing in the mining companies that produce critical minerals may offer attractive investment opportunities, as discussed in this video with Ed Coyne, Senior Managing Director at Sprott, and Steven Schoffstall, Director ETF Product Management.

Sprott Uranium Report

Key Trends for 2023 and December Recap

Three key themes for uranium markets in 2023: 1) increased emphasis on energy security worldwide; 2) higher conversion/enrichment prices may boost spot uranium prices; and 3) the global energy transition supports the case for nuclear power. Uranium's performance was notably strong in 2022, despite the overall bear market. Although uranium mining equities fared less well, we believe that the positive fundamentals for uranium and nuclear energy are likely to provide support in 2023.

Sprott Radio Podcast

2023 Uranium Outlook: Is Nuclear Power Out of the Penalty Box?

Per Jander of WMC Energy and John Ciampaglia, CEO of Sprott Asset Management talk with Sprott’s Ed Coyne about what may be ahead for uranium in 2023, the resurgence in nuclear power interest as energy security concerns become top of mind, and what’s happening in uranium conversion and enrichment.

Sprott Precious Metals Report

2023 Top 10 Watch List

This year’s top 10 list offers Sprott’s thoughts on what will likely drive markets in the coming year and decade, from a macro perspective and the vantage of our asset classes: Precious Metals and Energy Transition Materials. We believe the global clean energy transition will grow more urgent as energy markets continue re-ordering and energy security becomes synonymous with national security. The signposts point to a commodity-intensive, inflationary and capital-intensive decade where energy transition materials and precious metals will become far more valued than in the prior market regime.

Sprott Uranium Report

The Optimistic News Continues

The uranium markets did not perform as well as other sectors in November, despite having posted relatively strong performance throughout 2022. While the price of U3O8 uranium has lagged since May 2022, conversion and enriched uranium prices have significantly appreciated. We believe that current demand, coupled with a shift away from Russian suppliers, is likely to support a higher U3O8 uranium spot price.

Educational Video

Silver: A History of Innovation

Silver is used in every smartphone, desktop and laptop computer, and is essential for the construction of EVs, solar panels and many other technologies needed for the green economy.

Sprott Uranium Report

Uranium's October Optimism

The U3O8 uranium spot price climbed 8.32% in October, rising from $48.25 to $52.27 per pound. YTD as of October 31, 2022, the uranium spot price has climbed by 24.12%. We believe the uranium bull market remains intact despite the negative macroeconomic environment. Our outlook is supported by the unprecedented number of announcements for nuclear power plant restarts, life extensions and new builds that are all creating demand for uranium.

Educational Video

Uranium: Born of the Stars

Uranium, an element born of the stars, is as complex as it is paradoxical. This heavy metal holds dormant powers both inspiring and terrifying. This new video shares incredible facts about uranium’s inter-planetary origins and looks at the critical role of uranium in the burgeoning green energy economy.

Sprott Uranium Report

Uranium's September Setback

September was tough on uranium (both physical and stocks), which was negatively impacted by the month's drawdowns. We believe the uranium bull market remains intact, especially given that many countries are facing energy shortages and rocketing costs. Nuclear energy provides a solution as a reliable, affordable baseload energy source.

Educational Video

Gold: A True Store of Value

Throughout history, gold has played a prominent role in the advancement of human civilization. Seen as a representation of the sun, of the gods and of true value, gold is a form of real money without counterparty risks. Symbol Au, atomic number 79, gold has been used to adorn the tombs of the great pharaohs and to help power spacecrafts that extend the horizons of humanity’s domain. Learn about gold’s culture, uses and history.

Special Uranium Report

Why Nuclear Power Plant Life Extensions & Uprates Matter (...SMRs are in Early Stages)

Research and development on small modular nuclear reactors (SMRs) are underway globally and generating tremendous buzz. But SMRs are not likely to contribute meaningful amounts of carbon-free power for another decade. By contrast, nuclear power plant life extensions and uprates hold the power to boost carbon-free electricity production in the interim and provide a bridge to a future date when new SMR technologies will be commercially available.

Special Uranium Report

Uranium & Nuclear Power Play a Critical Role in the U.S.

Nuclear power generates more than 50% of the carbon-free electricity in the U.S. while meeting 20% of the country's electricity demand. As the country and the world take steps to tackle greenhouse gas emissions, we believe that uranium and nuclear power will be critical to the solution.

Important Disclosures

An investor should consider the investment objectives, risks, charges and expenses of each fund carefully before investing. To obtain a fund’s Prospectus, which contains this and other information, contact your financial professional, call 1.888.622.1813 or visit SprottETFs.com. Read the Prospectus carefully before investing.

Exchange Traded Funds (ETFs) are considered to have continuous liquidity because they allow for an individual to trade throughout the day, which may indicate higher transaction costs and result in higher taxes when fund shares are held in a taxable account.

The funds are non-diversified and can invest a greater portion of assets in securities of individual issuers, particularly those in the natural resources and/or precious metals industry, which may experience greater price volatility. Relative to other sectors, natural resources and precious metals investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Shares are not individually redeemable. Investors buy and sell shares of the funds on a secondary market. Only “authorized participants” may trade directly with the fund, typically in blocks of 10,000 shares.

The Sprott Active Metals & Miners ETF, Sprott Active Gold & Silver Miners ETF and the Sprott Silver Miners & Physical Silver ETF are new and have limited operating history.

Sprott Asset Management USA, Inc. is the Investment Adviser to the Sprott ETFs. ALPS Distributors, Inc. is the Distributor for the Sprott ETFs and is a registered broker-dealer and FINRA Member. ALPS Distributors, Inc. is not affiliated with Sprott Asset Management USA, Inc.